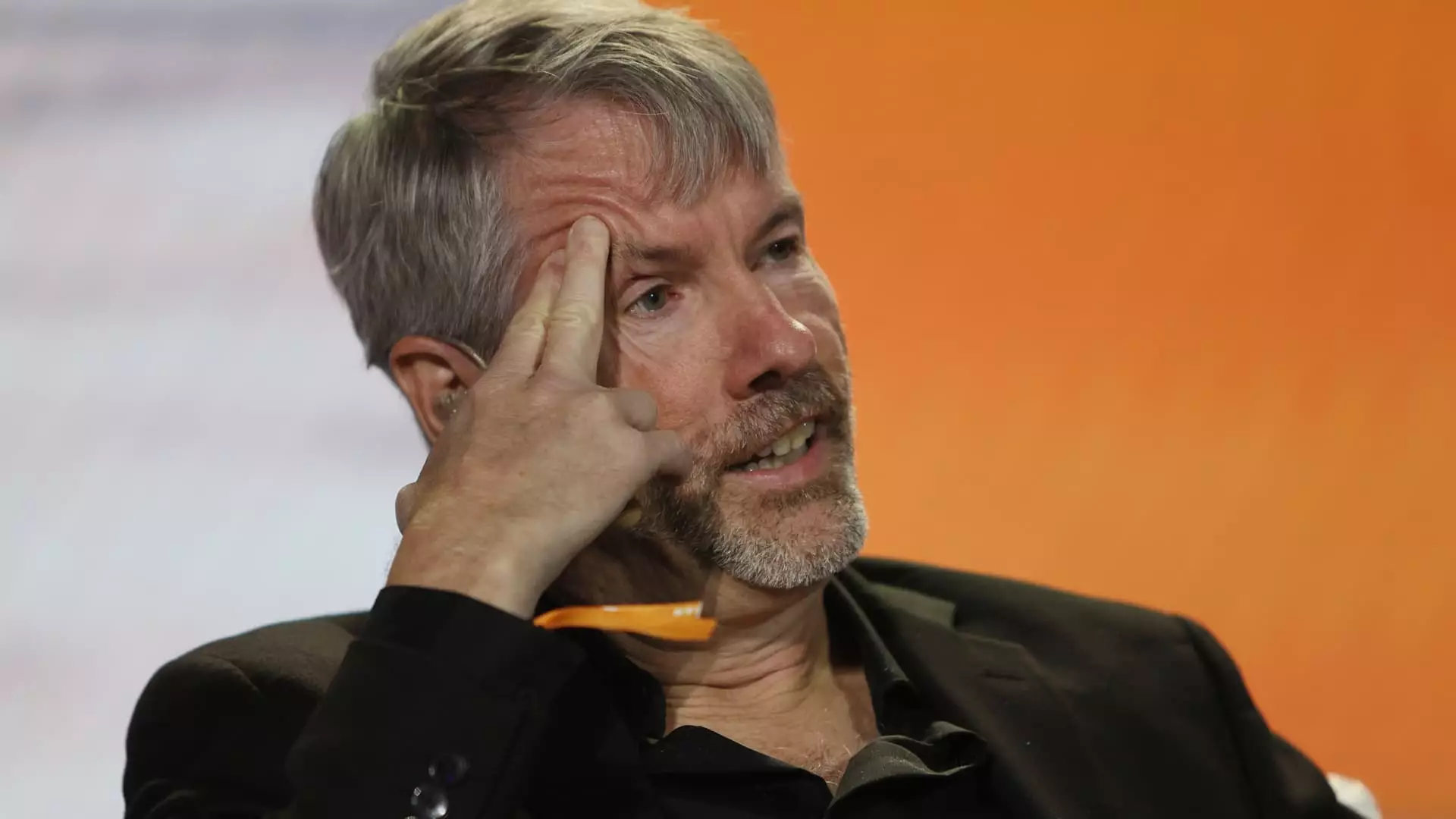

In the realm of technology investments, few narratives capture the imagination quite like the juxtaposition of conservative corporates and the volatile cryptocurrency market. One such story unfurled recently as Michael Saylor, the billionaire and executive chairman of MicroStrategy, pitched Microsoft on diversifying its substantial reserve of cash into Bitcoin. Despite Saylor’s fervent advocacy, Microsoft shareholders ultimately resoundingly turned down the proposal. This article delves into the implications of Saylor’s failed bid, the contrasting corporate cultures, and the evolving landscape of cryptocurrency as corporate strategy.

Saylor’s enthusiasm for Bitcoin is anecdotal; his company, MicroStrategy, transformed from a traditional software firm into a significant player in the cryptocurrency arena. With a staggering 500% increase in their stock value over the year, largely attributed to Bitcoin investments, Saylor’s strategy appears almost prescient. However, the proposal he presented at Microsoft’s annual shareholder meeting was met with reluctance. Despite Saylor’s high-profile promotional efforts—including a compelling three-minute video that garnered over 3 million views—Microsoft’s shareholders sided against him. They were swayed by prior recommendations from influential proxy advisors, advocating for a rejection of the proposal.

Microsoft’s innate caution surrounding the high-stakes world of cryptocurrency is emblematic of its broader corporate ethos. With $78.4 billion in cash reserves, the tech giant has considerable liquidity to explore alternative investments. However, Microsoft’s trepidation is not unfounded; fluctuation in the cryptocurrency market could potentially destabilize an otherwise solid financial foundation.

Saylor was not short on statistics to bolster his case. He used compelling data to illustrate Bitcoin’s outperforming metrics—62% annual returns against Microsoft’s 18% and the S&P 500’s 14% from August 2020 to November 2024—making a strong argument in favor of allocating resources to Bitcoin. He laid out the attractiveness of converting Microsoft’s cash flows or buyback strategies into cryptocurrency.

Nevertheless, even with this data, the disparity between Saylor’s aggressive, risk-tolerant investment philosophy and Microsoft’s risk-averse corporate governance model became blatantly clear. Microsoft CEO Satya Nadella, while previously acknowledging the value of digital currencies, has adopted a more conservative stance towards outright investments in such volatile assets.

The fundamental dissonance between Saylor’s and Microsoft’s perspectives epitomizes a broader clash in corporate governance within the tech sector. While tech companies often seek disruptive innovations to secure their market positions, they must also balance shareholder interests against significant risks. Microsoft is emblematic of established tech giants like Apple and Google, which prioritize stability over short-term profitability spikes.

On the contrary, MicroStrategy’s strategy embodies a braver ethos, embracing Bitcoin not only as an investment vehicle but as a cornerstone of its corporate identity. Following their commitment to Bitcoin in mid-2020, they have converted traditional capital-raising methods—selling stock and taking on debt—into avenues for cryptocurrency accumulation, visibly aligning their capital structure with Bitcoin’s performance.

As these contrasting philosophies play out, both firms must consider future scenarios. Will Microsoft ever adjust its strategy to embrace elements of Saylor’s viewpoint? The company’s finance chief, Amy Hood, hinted at a continued exploration of crypto but emphasized that their current operations and investment strategies would evolve cautiously and pragmatically.

For Saylor and MicroStrategy, the coming months and years will be pivotal. Their high-stakes model could either solidify their status as trailblazers in the cryptocurrency space or subject them to the pitfalls of market fluctuations should Bitcoin experience a downturn.

Saylor’s ambitious pitch to Microsoft underlines a significant intersection between traditional corporate strategies and the burgeoning realm of cryptocurrencies. While the tech behemoth has opted for caution, Saylor’s unyielding conviction in Bitcoin reflects a broader conversation about the future of capital allocation in an increasingly digital world. The ongoing dialogue between risk and stability will undoubtedly shape the future strategies of corporate giants moving forward.