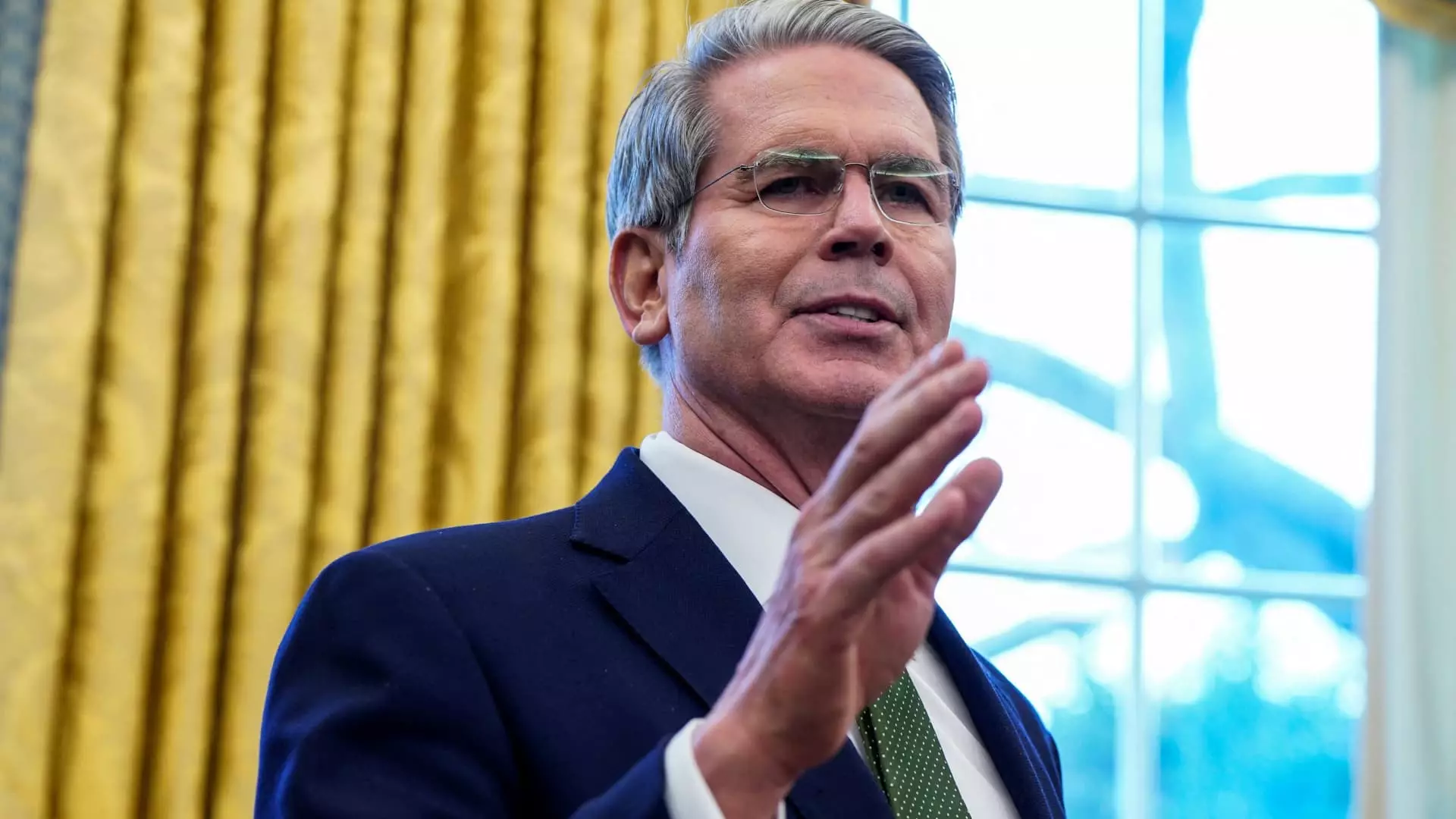

Under the Trump administration, a noticeable divergence in fiscal and monetary policy has emerged, particularly concerning the treatment of Treasury yields. Treasury Secretary Scott Bessent articulated the administration’s concentrated objective: maintaining low Treasury yields rather than fixating on the actions of the Federal Reserve. This marked a significant departure from past administrations that often viewed the Fed’s interest rate maneuvers as pivotal. Instead, Bessent emphasized a strategy that leverages fiscal policy components to achieve lower rates, especially spotlighting the critical role of the 10-year Treasury yield as a benchmark rather than the federal funds rate.

This pivot is telling, reflecting a pragmatic acknowledgment that despite the Fed’s influence on pressing economic metrics, fiscal policy plays an equally potent role in steering the economy. The consistent focus on the 10-year Treasury yield suggests the administration’s intention to favor long-term interest rates, which tangibly impact consumer borrowing costs in areas such as mortgages and auto loans.

The Interplay Between Rates and Economic Policies

Bessent’s remarks suggest a refined understanding of how various financial products are interconnected through underlying rates. The Fed’s rate-setting capabilities may set the stage for short-term lending rates, but it is the long-term bond yields that resonate more profoundly with consumer finance and overall economic sentiment. The backdrop of these statements was the Fed’s recent transition into a cycle of rate reductions, cutting the benchmark rate by one whole percentage point starting in September 2024. Traditionally, such cuts would amplify expectations for lower borrowing costs across the economy. However, recent data indicated that Treasury yields surged following the Fed’s cuts, which counteracts the intended effects of lower short-term rates.

This contradiction raises essential questions about the efficacy of current monetary policy. While the Fed works to support the economy through rate cuts, the concurrent increase in Treasury yields signals market apprehension, possibly fueled by inflation expectations. The implications for consumer loans and housing markets are profound, as rising long-term rates could stymie economic recovery efforts.

Bessent conveyed a distinctly Trumpian economic philosophy during his interview, citing a belief that deregulation, impactful tax initiatives like the Tax Cuts and Jobs Act, and an emphasis on energy independence would create an environment favorable to economic growth and, by extension, lower interest rates. This philosophy harbors an underlying premise: that various policy measures can organically stabilize rates without excessive Fed intervention. The administration appears confident that the economic landscape can be positively influenced by an orchestration of fiscal measures rather than direct manipulation of monetary policy.

Statements emphasizing efficiency in government spending, reduction of government size, and improved regulatory environments reflect a multifaceted approach to economic management. By appealing to these foundational principles, the Trump administration aims to foster conditions where interest rates remain manageable, thereby buoying markets and consumer sentiment.

Analysts, such as Krishna Guha from Evercore ISI, view the administration’s targeted focus on the 10-year yield as essential to sustaining what he describes as Trumponomics. In his analysis, maintaining this yield below 5 percent is crucial; breaching this threshold could lead to more erratic market conditions and potentially destabilize sectors sensitive to interest rates, including equities and housing. The most recent trading saw the 10-year Treasury yield at 4.45%, down from a peak of 4.8% earlier in the year, further underscoring the administration’s trenchant need to monitor these economic indicators closely.

Trump’s recent endorsement of the Fed’s decision to maintain the funds rate reveals not just a collaborative approach but also aligns with broader market expectations, potentially easing concerns. As the administration continues to pursue its fiscal agenda, including making tax cuts permanent, the delicate balance between fostering economic growth and monitoring long-term interest rates will be a critical determinant of its overall success.

The Trump administration’s unique focus on Treasury yields over direct Fed actions is an illustration of its broader economic philosophy and strategy. By prioritizing long-term economic health through targeted fiscal policies, the administration seeks to create an environment that will inherently support lower interest rates. The complexity of the interdependencies between monetary and fiscal actions will shape both their legacy and the broader economic landscape for years to come.