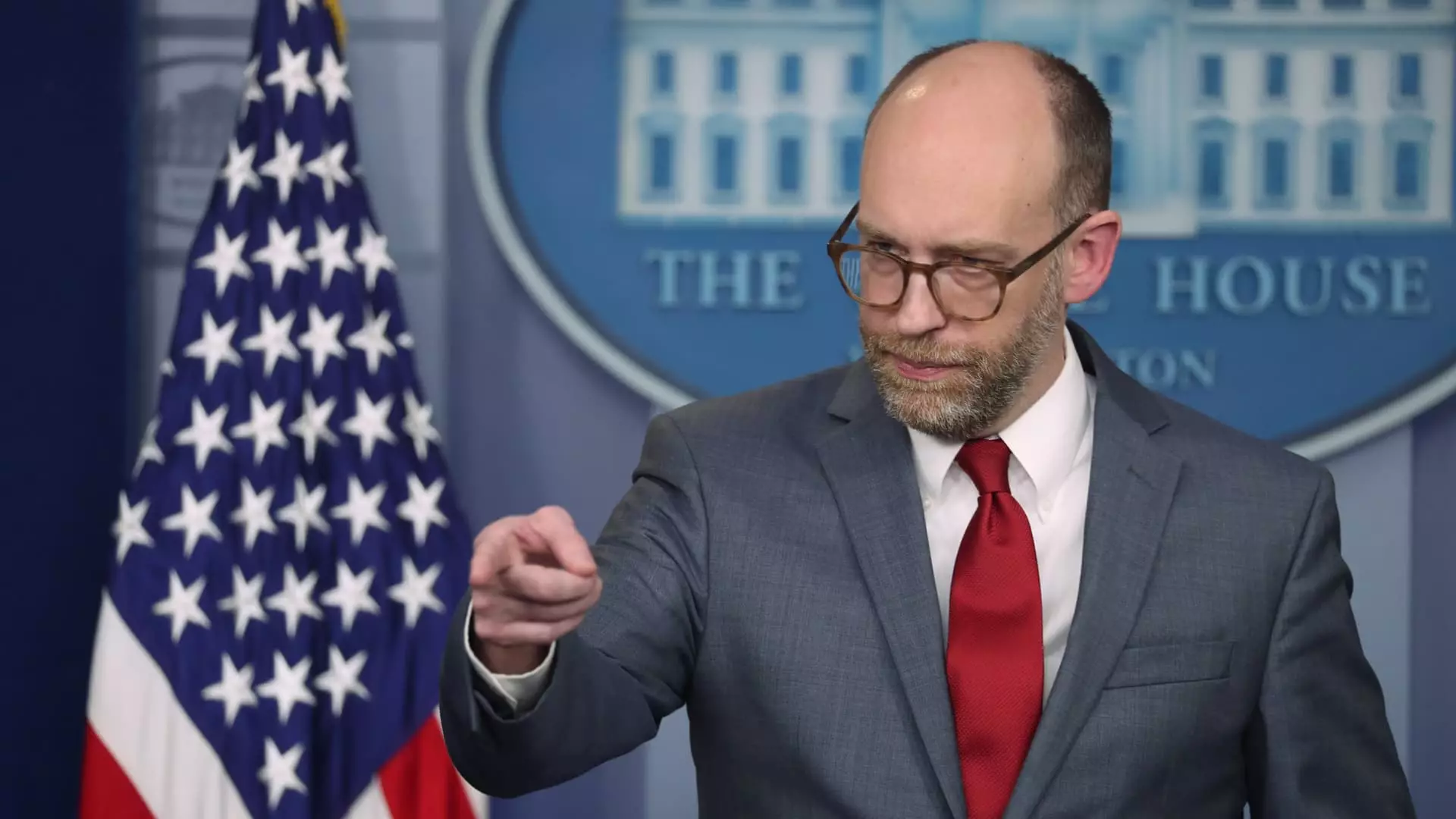

The Consumer Financial Protection Bureau (CFPB) has found itself embroiled in a whirlwind of uncertainty after recent decisions made by its new acting director, Russell Vought. In a memo circulated on Sunday, employees were officially instructed to work remotely, as the agency’s Washington, D.C. headquarters remains closed until February 14. Vought’s actions, which include a suspension of nearly all regulatory activities, raise significant questions about the bureau’s future and operational integrity.

Vought’s installation as the acting director signals a broader shift in the goals and ethos of the CFPB. His immediate directive to freeze the agency’s functions — crucially, the oversight of financial firms — points toward a concerning pivot away from consumer protection. This transition occurs in the context of growing tensions between regulatory bodies and private interests, particularly with influences from technology moguls. The involvement of operatives linked to Elon Musk’s DOGE has further complicated matters, suggesting a potentially disruptive merger of private sector ambition and public regulatory oversight.

Elon Musk’s engagement with the CFPB — particularly his previous calls for its dismantling — raises alarm bells regarding the autonomy of regulatory bodies. Reports indicate that DOGE personnel have gained access to sensitive CFPB data, including employee performance reviews. Such actions may undermine not only the security but also the motivational integrity of CFPB employees, inviting an invasive scrutiny that could dramatically alter the agency’s operational fabric. This intersection of tech enterprise and regulatory authority prompts critical discussions about the safeguarding of consumer interests.

Additionally, Vought announced a halt on the allocation of fresh funding to the CFPB, stating that the agency’s historical unaccountability is now under immediate scrutiny. This decisive move reflects an aggressive stance towards reshaping how the CFPB operates, aligning with the strategic vision of Project 2025 — an initiative aimed at reengineering the federal government’s structure. By turning off what Vought refers to as a “spigot” of unchecked financial resources, he is not only limiting the agency’s capabilities but also influencing the broader narrative around consumer financial protections.

As developments unfold, the future of consumer protections appears increasingly precarious. With regulatory functions on hold and financial oversight in jeopardy, the CFPB’s ability to fulfill its mission is significantly threatened. Stakeholders within both the public and private sectors must act to monitor these changes closely, recognizing their potential ramifications for consumer advocacy. The industry awaits updates on these pressing issues, bracing for a possible seismic shift in the regulatory landscape that governs consumer finance.

The current chapter of the CFPB’s story is marked by dramatic leadership shifts and external pressures that could reshape the agency’s purpose and functionality. It remains critical for advocates and consumers alike to stay informed and engaged as the situation continues to evolve.