In recent developments at the Federal Reserve, a concerning trend has emerged: the rise of dissonant voices challenging the consensus on interest rate policies. Federal Reserve Governor Stephen Miran’s audacious veto against the majority’s decision to cut rates by 0.25%, advocating instead for a dramatic 0.50% reduction, is emblematic of a deeper problem—one of politicization and reckless independence. His dissent was not merely a technical disagreement; it signals a willingness to destabilize an already delicate economic foundation based on personal ideology rather than data-driven consensus. Such a bold move from a newly confirmed governor, especially one with ties to political figures seeking to influence monetary policy, lays bare the risk of eroding the Federal Reserve’s credibility and the delicate balance needed to foster sustainable growth.

Political Intrigue Threatening Economic Prudence

Miran’s dissent aligns with a broader pattern of political meddling, especially given the context of his rapid ascendancy into the Fed. His appointment, orchestrated in the shadow of presidential influence, raises uncomfortable questions about independence. Historically, the Fed’s strength lies in its apolitical stance—free from partisan pressures that could distort critical decisions. Instead, we see Miran advocating for an aggressive rate cut, echoing calls from political figures like former President Trump, who openly expressed desires for even lower interest rates—by two to three percentage points. This push from political actors undermines the integrity of monetary policy and risks turning the Fed into an instrument for short-term political gain, rather than a guardian of long-term economic stability.

The Fragile Confidence in Federal Reserve Decision-Making

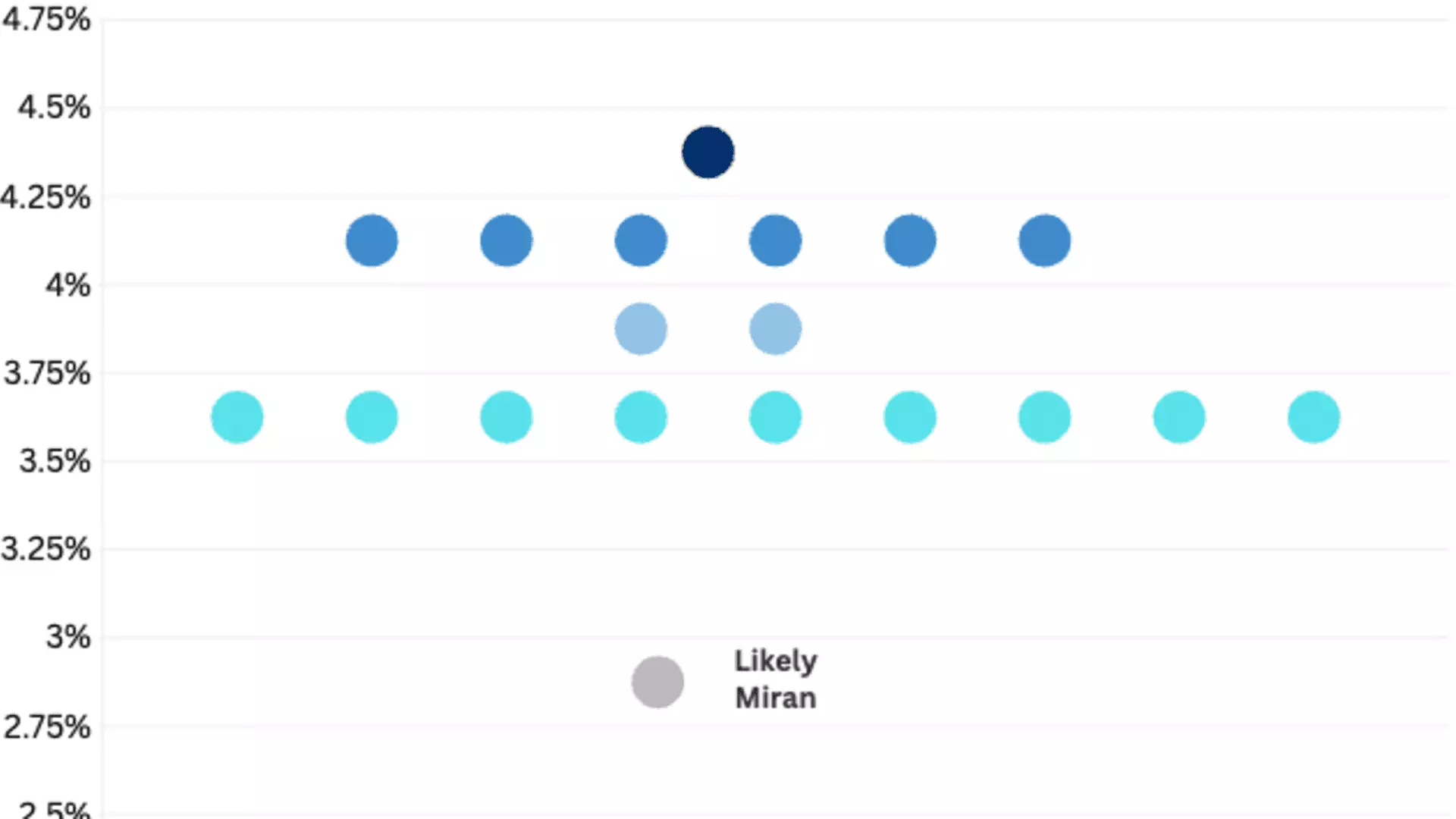

Such internal disagreements, especially when amplified by political influence, threaten the public’s trust. The Fed’s dot plot, which visually encapsulates the divergence of future rate expectations among policymakers, is now revealing a dangerous rift—some members foresee no more than two cuts in 2025, while others, like Miran, envision a far steeper decline. This mosaic of conflicting forecasts breeds uncertainty, which can deter investment, disturb markets, and ultimately impair economic growth. When key officials publicly dissent in ways that seem driven by outside influences, it reinforces perceptions of chaos, making it more difficult for markets and consumers to plan for the future with confidence.

The Erosion of Federal Independence and Its Consequences

The appointment of officials such as Miran, seemingly motivated by political considerations—especially considering Trump’s vocal desire to influence the Fed—raises alarms about the long-term health of American monetary policy. These politicized appointments threaten to diminish the independence that has traditionally insulated the Fed from electoral cycles and partisan interests. A politicized central bank risks embracing short-term objectives instead of prioritizing macroeconomic stability, inflation control, and employment. The risk isn’t just theoretical; history demonstrates that politicization often leads to inflationary spirals, financial crises, or misdirected policy efforts that can take years to rectify.

The Future of the Federal Reserve in a Politicized Climate

By aligning itself with political narratives, the Fed risks losing its core function: maintaining economic stability through autonomous decision-making. Miran’s aggressive dissent and the broader political machinations cast a shadow over the institution’s legitimacy. It becomes increasingly clear that the Federal Reserve must resist these pressures and reaffirm its independence. The health of the economy, the livelihoods of millions, and the nation’s financial future depend on a central bank that prioritizes expertise over expediency, evidence over ideology, and stability over spectacle. To preserve its stature, the Fed must critically evaluate the roles and motivations of its members and reject the siren call of political manipulation—because in the end, stability is the greatest power a monetary authority can wield.