In a striking development within the technology sector, global semiconductor stocks experienced a significant rise following the announcement of record fourth-quarter revenues by Foxconn, the world’s largest contract electronics manufacturer. Hon Hai Precision Industry, widely known as Foxconn, reported a remarkable revenue of 2.1 trillion New Taiwan dollars (approximately $63.9 billion), marking a 15% increase year-over-year. This impressive performance not only emphasizes the robust demand for semiconductor products but also suggests that the artificial intelligence (AI) sector has a long way to go before reaching its peak. The surge in Foxconn’s revenues underscores the transformative impact of AI on the tech landscape, benefiting suppliers, manufacturers, and related firms alike.

This remarkable revenue growth can be attributed to the surging demand for advanced cloud and networking products, including AI servers that are essential for various applications. As companies like Nvidia continue to innovate, Foxconn’s ability to adapt to these demands is indicative of a healthy and evolving semiconductor ecosystem. Despite the positive news, it is noteworthy that some segments of Foxconn’s business, specifically computing products and smart consumer electronics, such as iPhones, faced slight declines. This paradox highlights the shifting dynamics where traditional consumer electronics are encountering challenges while high-tech innovations in AI and networking are blooming.

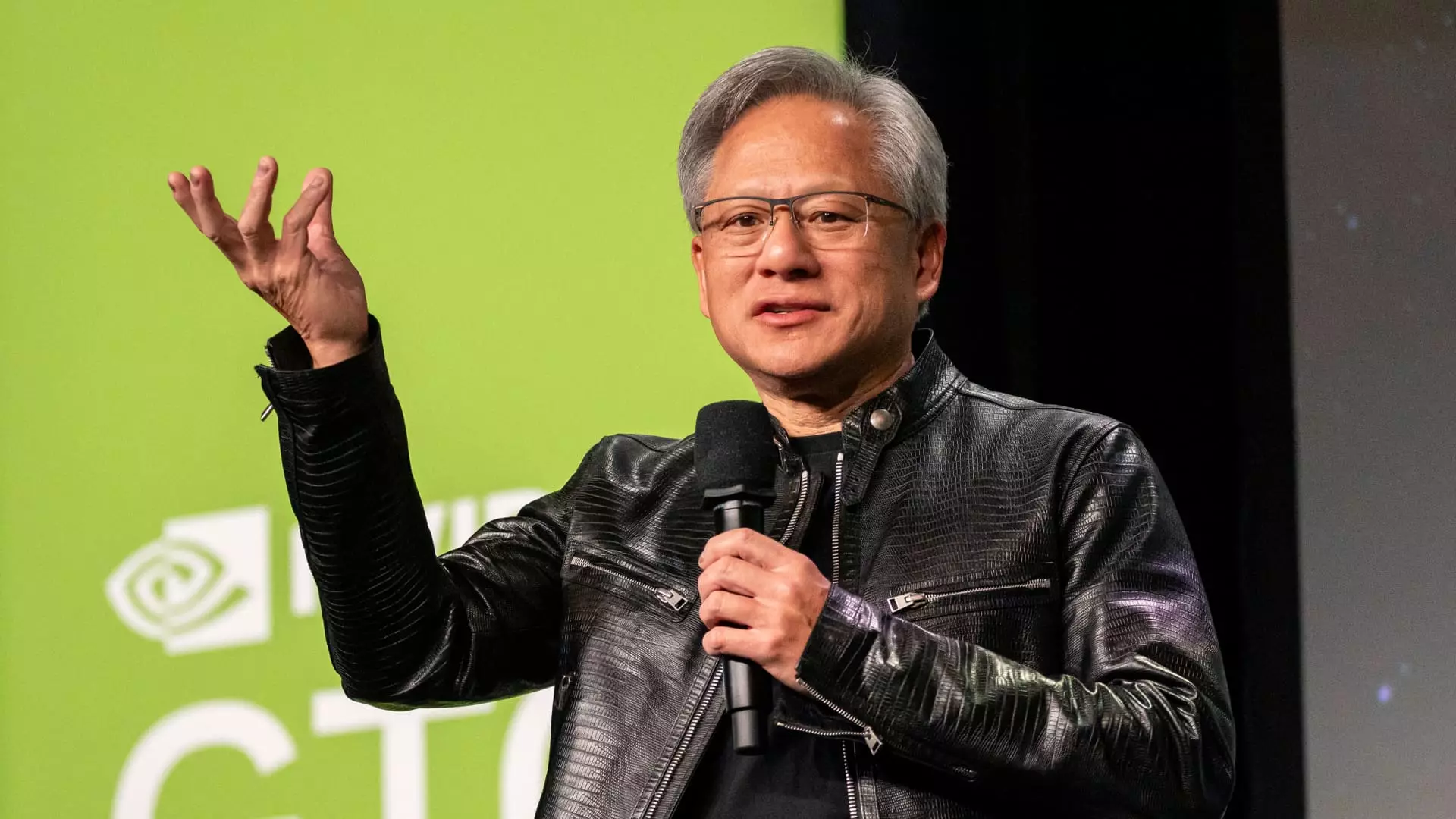

The effects of Foxconn’s revenue announcement rippled through the stock markets, causing shares of semiconductor firms to surge across various regions, including Asia, Europe, and the United States. In particular, Nvidia experienced a notable uptick, closing up more than 3% in response to the optimistic data from Foxconn. The timing of this boost coincided with Nvidia CEO Jensen Huang’s scheduled keynote at the 2025 Consumer Electronics Show, further invigorating investor interest. Moreover, the broader tech landscape benefited from Microsoft’s recent pledge to invest $80 billion in 2025 for developing data centers capable of supporting AI workloads, an investment that will largely see Nvidia’s GPUs being utilized. Such strategic moves by major corporations signal a future deeply intertwined with AI, reinforcing the need for advanced processing capabilities.

AMD, as Nvidia’s close competitor, also enjoyed a gain exceeding 3%, while Qualcomm and Broadcom, key players in the semiconductor space, recorded incremental rises as well. These developments reveal a collective trajectory toward growth, demonstrated by the supportive networks that tech giants are fostering to bolster their operational capacities. The pronounced dedication of titans like Microsoft towards technological advancement highlights an industry trend where substantial investments are funneled into AI infrastructure, ultimately solidifying the position of semiconductor manufacturers as essential contributors to future innovation.

The positive momentum was not limited to American stocks; semiconductor manufacturers across Asia also saw steep increases. Taiwan Semiconductor Manufacturing Company (TSMC), the leading global chip maker, hit a record high, closing up nearly 5%. TSMC’s performance reflects the foundational role it plays in the semiconductor supply chain, as it produces chips for major companies like AMD and Nvidia. Other Asian firms, including South Korea’s SK Hynix and Samsung, echoed this success with respective increases of nearly 10% and 4%, indicating a robust regional response to global market demands.

In Europe, companies such as ASML and ASMI also saw notable stock increases. ASML, a critical supplier of semiconductor equipment, closed at 8.7% higher, while ASMI saw gains of approximately 6.2%. These developments indicate that the semiconductor market’s health is not only a regional phenomenon but a global one, with disparate markets reacting positively to unified trends driven by technological advancements.

The recent developments in the semiconductor and tech industry suggest promising growth trajectories fueled by AI and cloud computing demands. The record-breaking performance by Foxconn is an indicator of a larger narrative in which AI technologies are not merely auxiliary to traditional computing but are redefining the operational landscape. As market leaders commit to significant investments in AI capabilities, the allure of the semiconductor sector will likely continue to strengthen. This sustained interest in the semiconductor landscape emphasizes the pivotal role these firms will play in the global economy and technology advancement in the years to come. As the industry evolves, vigilance regarding market dynamics will be paramount to understanding how best to navigate this ever-shifting terrain.