In an age where the stock market appears to swing on the whims of political maneuverings, Warren Buffett’s Berkshire Hathaway stands as an unexpected fortress. As President Trump’s combative trade policies set Wall Street ablaze, dragging down indices like the S&P 500 and the tech-heavy Nasdaq, Berkshire Hathaway showcased a measure of fortitude that not only protected its investors but also affirmed its iconic status in the realm of investing. In a week characterized by a heart-stopping 9.1% decline in the S&P 500, Berkshire’s class B shares retreated by a comparatively modest 6.2%. While many fled to the sidelines, preferring the allure of cash reserves, this conglomerate proved that strategic financial architecture could provide solace amidst chaos.

User-Centric Business Model

Berkshire Hathaway’s resilience can be attributed to its diversified investments across sectors that remain insulated from political shocks. Unlike many tech firms that hang precariously on the pendulum of international relations and tariff implications, Berkshire’s engagement with domestic businesses positions it to weather the storm better than most. With significant stakes in insurance, manufacturing, and energy, the conglomerate embodies a user-centric business model anchored by its defensive assets. It is this identity that has allowed it to remain above the fray of panic-driven sell-offs.

Amidst every alarming market headline, Berkshire’s innate ability to adapt and provide fundamental value remains evident. It’s well-known that Buffett is a proponent of long-term investments. In contrast to today’s trend of knee-jerk reactions to policy changes, Buffett’s approach advocates for patience. This contrasts sharply with a majority of market players, who seem to be stricken with a fear of the unknown, ravaging portfolios without considering the underlying health of companies.

Investment Philosophy in a Political Landscape

The political landscape, particularly in the age of Trump, is akin to a roller coaster ride—volatile and unpredictable. Yet, Buffett and his conglomerate deftly navigate this tumultuous environment. As tariffs threatened the very framework of international trade, eroding investor confidence in many sectors, Berkshire offered a beacon of hope. With $334 billion in cash reserves, the company is well-equipped to withstand storms or seize opportunities as they arise. This financial prowess gives investors confidence, encouraging them to consider Berkshire a haven even amidst uncertainty.

Critics of tariffs and aggressive trade policies often overlook the implications of systemic instability on financial markets. Trump’s imposition of tariffs reflects a broader detachment from the reality of interconnected economies. However, Buffett’s strategies emphasize the importance of sound inter-business relationships over shortsighted political gain. In many ways, Buffett’s worldview offers a stark counter-narrative to the isolationist tendencies that may lead to long-term economic detriment. This perspective of interdependence is not just a byproduct of his business strategies; it’s a fundamental principle that should guide national economic conduct.

A Dissenting Voice in a Discordant Market

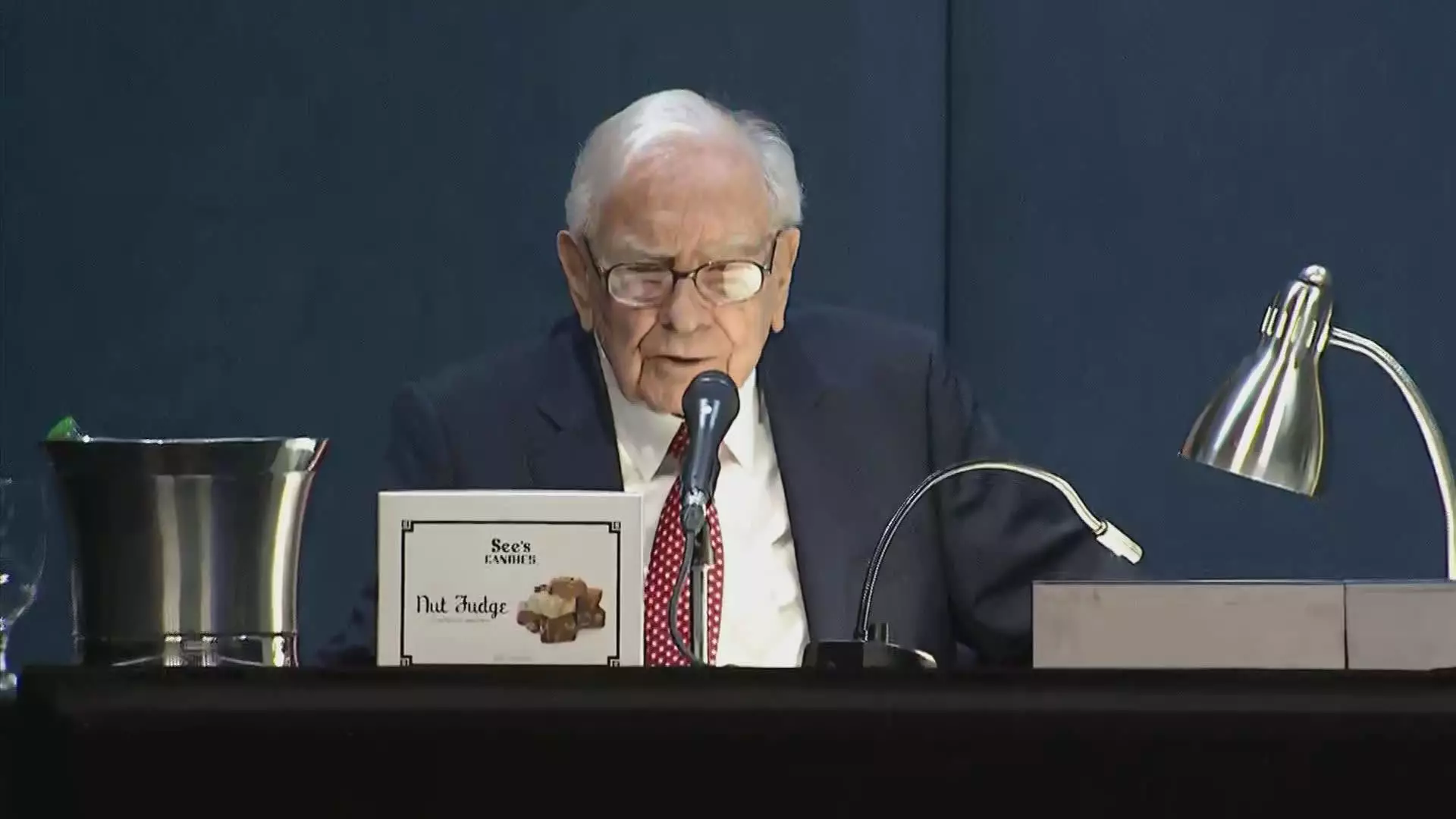

In a recent flurry of misunderstanding and misinformation, Buffett found himself at the center of controversy. Trump’s insinuation that the iconic investor purportedly blamed him for market volatility was swiftly dismissed by Buffett. This episode serves as a reminder of the often-turbulent intersection between finance and politics, where narratives can be distorted to fit agendas. In an industry already rife with speculation, Buffett remains an anchor of rationality. He reminds investors not to get swept away by the noise but to focus on fundamental analysis and long-term value—a lesson increasingly needed in our age of outrage and clickbait headlines.

The fact that Berkshire remains one of the few large-cap stocks above its 200-day moving average is not merely a reflection of Buffett’s brilliance; it underscores a form of investor sanity in an otherwise chaotic market landscape. Many are waking up to the realization that traditional metrics should guide decisions rather than reactive tendencies fed by sensational political commentary.

Ultimately, as we witness the tremors of a potential trade war ripple across markets, it’s clear that Warren Buffett’s Berkshire Hathaway is not just another company. It embodies a philosophy of resilience, prudence, and strategic foresight—qualities that stand in stark contrast to the erraticism of contemporary political discourse. Amidst such uncertainty, one can only hope that more investors, policymakers, and business leaders adopt similar principles for the prosperity of the wider community.