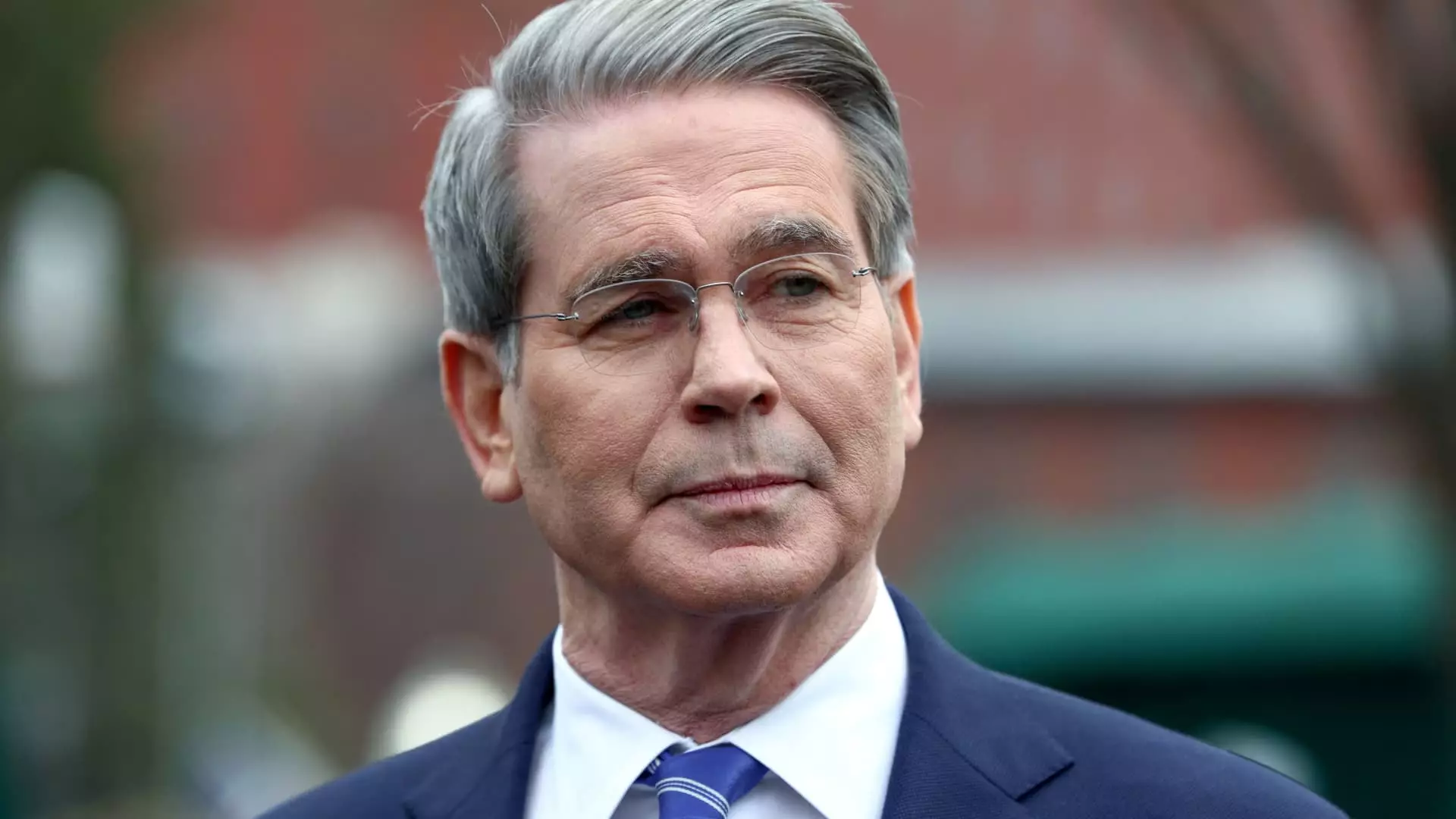

In an era where economic uncertainty looms large, Treasury Secretary Scott Bessent’s remarks on NBC’s “Meet the Press” provide an interesting glimpse into the collective psyche of a government that seems resolute, perhaps obstinately so, in its pursuit of long-term prosperity through short-term turbulence. As he dismissed worries about a possible recession and Americans’ retirement plans, Bessent boldly claimed that narratives of impending doom are “false.” But this seems more wishful thinking than a grounded assessment of economic realities.

For those on the cusp of retirement, the implications of a volatile stock market are decidedly more personal than Bessent’s platitudes suggest. Many Americans have carefully planned their retirement based on their nest eggs, often heavily invested in the stock market. While it’s true that some might not micro-manage their investments, the abrupt market downturn triggered by President Trump’s announcement of substantial tariffs on major trading partners raises justifiable concerns. To minimize the gravity of these fluctuations as just another bump in the road seems to gloss over a profound emotional and financial reality — for many, it’s not just about day-to-day fluctuations but the very future they’ve anticipated.

The Tariff Fallout: A Blow to Earned Confidence

Bessent’s claims about the resilience of American workers and investors come at a time when the stock market has lost ground at rates not seen since the early days of the COVID pandemic. He reassures us that this wide-reaching downturn is a part of a long-term economic strategy, using Ronald Reagan’s management of inflation as a guiding example. But this comparison feels strained; Reagan’s era faced different economic challenges, primarily inflations stemming from oil crises, and a global economic landscape that bears stark contrasts to today’s interconnected world.

By refusing to acknowledge the immediate pain caused by policy decisions, Bessent and the administration risk alienating the very citizens they profess to serve. In fact, Trump’s calls for Americans to “hang tough” under the weight of market instability sound increasingly hollow as they are repeated in the face of economic realities that impact ordinary people’s livelihoods. For some, “hanging tough” means risking the very financial security they’ve worked so hard to build. The potential long-term benefits of tariffs, as touted by the administration, can hardly soothe the immediate concerns of retirees watching their savings dwindle.

The Specter of Misplaced Optimism

What’s confounding is Bessent’s unwavering confidence in his economic strategy. He waves away significant market interventions, insisting that these are merely necessary adjustments, a deflection of blame onto prior administrations and international trade partners. Yet, the assumption that historical patterns will neatly repeat themselves under present circumstances comes off as naïve. Economic cycles do not adhere strictly to historical precedents; they are affected by countless variables, many of which are not easily predicted or controlled.

This rhetoric of a long-term vision, divorced from immediate feedback and tangible realities, raises the question: How long can the American public be expected to endure economic pain for a potentially idealized future? The disconnect between policy-making and the citizen experience can foster a deep mistrust in leadership. Bessent’s analysis implies that the underlying economic structure is sound when many feel daunted by everyday survival rather than buoyed by fanciful projections of future revitalization.

Understanding Complexity: Beyond Simple Narratives

One must wonder, then, how long the current administration intends to rely on the mantra of “building long-term fundamentals” without providing concrete pathways or timelines. It is the duty of policy officials to communicate not only the optimism they hold for future conditions but also an empathetic understanding of the tangible ramifications policies have on citizens today. To portray economic resilience without acknowledging the pain of the present feels disingenuous — a political dodge rather than a legitimate response to genuine concern.

Ultimately, navigating economic uncertainty requires more than mere belief in long-term strategies. It demands a nuanced understanding of the lives affected, the unpredictability of markets, and the willingness to adjust course when necessary. Confidence is necessary, yet it must be tempered with realism, empathy, and an earnest desire to address the myriad challenges facing Americans today. As the political landscape evolves, let us hope that the narrative promotes inclusivity and genuine discourse rather than stubborn adherence to blindly optimistic forecasts.