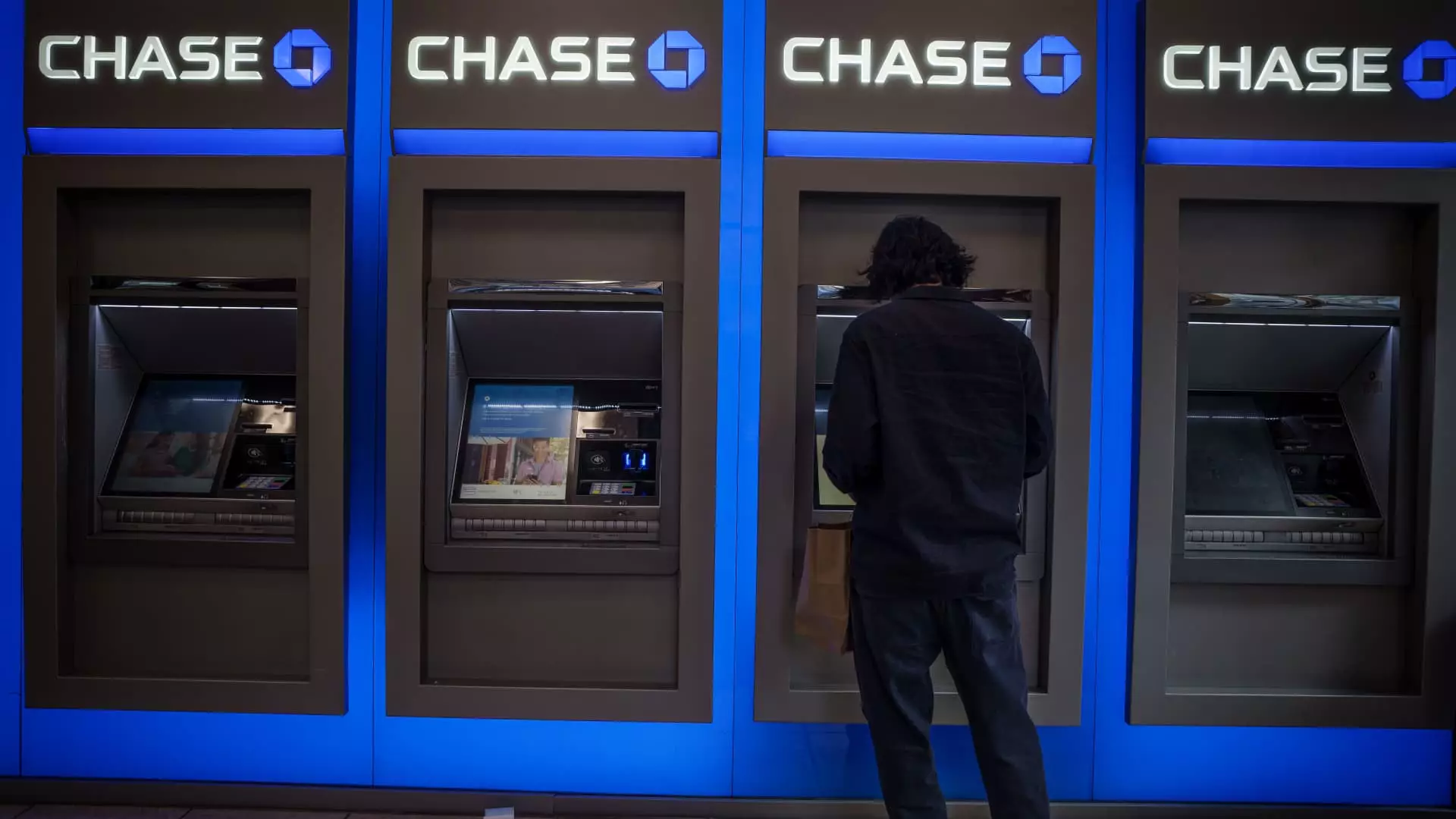

In late August 2024, a significant scandal erupted across social media platforms, particularly TikTok, where users discovered and shared a technical glitch that allowed individuals to withdraw funds from ATMs before checks had cleared. Dubbed the “infinite money glitch,” this exploit became a viral sensation, enticing numerous people to partake in what they believed was an innovative trick to obtain free money. As a consequence, JPMorgan Chase, the largest bank in the United States, is now grappling with the fallout from this phenomenon, which has initiated a wave of legal actions against its own customers.

On Monday, JPMorgan Chase commenced litigation in at least three federal courts against customers who allegedly misused the ATM system to siphon off substantial sums of money under this glitch. The most notable case involves a Houston-based individual who reportedly owes the bank an astonishing $290,939.47. This amount stems from a counterfeit check deposited at an ATM, which was followed by rapid withdrawals from the account in question. According to court filings, the offending party began to extract the funds almost immediately after the fraudulent check was deposited.

As reports demonstrate, this legal pursuit aims not merely to recoup lost funds but also to underscore the seriousness with which the bank views these actions. Each lawsuit filed emphasizes the violation of deposit agreements signed by customers, which delineate the terms of engagement with the bank’s financial services.

The implications of the infinite money glitch stretch far beyond isolated incidents. JPMorgan’s internal investigations have revealed thousands of possible cases connected to the incident. While the bank has not revealed the total financial losses incurred, the scale suggests a significant disruption within its operations. Despite digital transactions eclipsing traditional checks in popularity, the vulnerability inherent in check processing remains a notable concern for financial institutions.

In 2023 alone, check fraud resulted in staggering losses estimated at $26.6 billion globally. Such data reinforces the importance of safeguarding banking systems against exploitation, illustrating how a singular technological parable—like that leveraged in August—can spiral into widespread financial chaos.

The lawsuits initiated by JPMorgan Chase are indicative of a broader strategy to address fraudulent activities while simultaneously dissuading future infractions among customers. The specific cases being pursued include significant sums ranging from $80,000 to $141,000, with prioritization given to amounts that suggest potential links to organized crime. This vigilance reflects the bank’s determination not just to reclaim lost assets but to reinforce its reputation and security protocols.

In these complex cases, the bank seeks recovery of not only the stolen funds but also interest, overdraft fees, and legal expenses incurred in the process. Furthermore, by referring some of these matters to law enforcement, JPMorgan is signaling to both customers and the broader public that it is serious about tackling fraud head-on, emphasizing that deceptive practices erode public trust in the banking system.

The proliferation of the infinite money glitch underscores a significant issue: the role social media plays in magnifying financial vulnerabilities. What may begin as an innocent or humorous post can lead to widespread fraud, placing banks in a precarious position. As individuals glamorize ill-gotten gains, financial institutions must balance the pursuit of justice with maintaining consumer relationships, navigating a dual responsibility.

JPMorgan Chase’s legal actions against customers exploiting the infinite money glitch reflect a concerted effort to rein in financial misconduct while educating the public about the legal consequences of fraud. As the banking landscape continually evolves, it remains imperative that both institutions and individuals prioritize ethical practices. Ultimately, the enduring lesson from this incident is that financial integrity must be upheld to sustain a healthy economy and preserve trust in the banking system.