The latest analysis from the National Institute of Economic and Social Research (NIESR) paints a bleak picture of the UK’s fiscal future. It highlights an urgent and uncomfortable truth: the government is heading toward a fiscal crisis that could drastically undermine economic stability. The projection indicates that, by the fiscal year 2029-30, the UK will need to find over £40 billion in either new tax revenue or significant spending cuts simply to meet its own fiscal rules. This looming gap isn’t just a statistical anomaly; it’s a stark revelation of systemic issues that demand immediate attention.

What’s most alarming is the scale of the shortfall—£41.2 billion— which underscores just how disconnected UK economic policies have become from sustainable management. The government’s reliance on optimistic assumptions about growth and borrowing has left it unprepared for the reality of sluggish progress and mounting fiscal pressure. The predictions suggest that without drastic policy shifts, the UK’s fiscal health will be in jeopardy by the end of this decade, exposing households and businesses alike to increasing risks of instability.

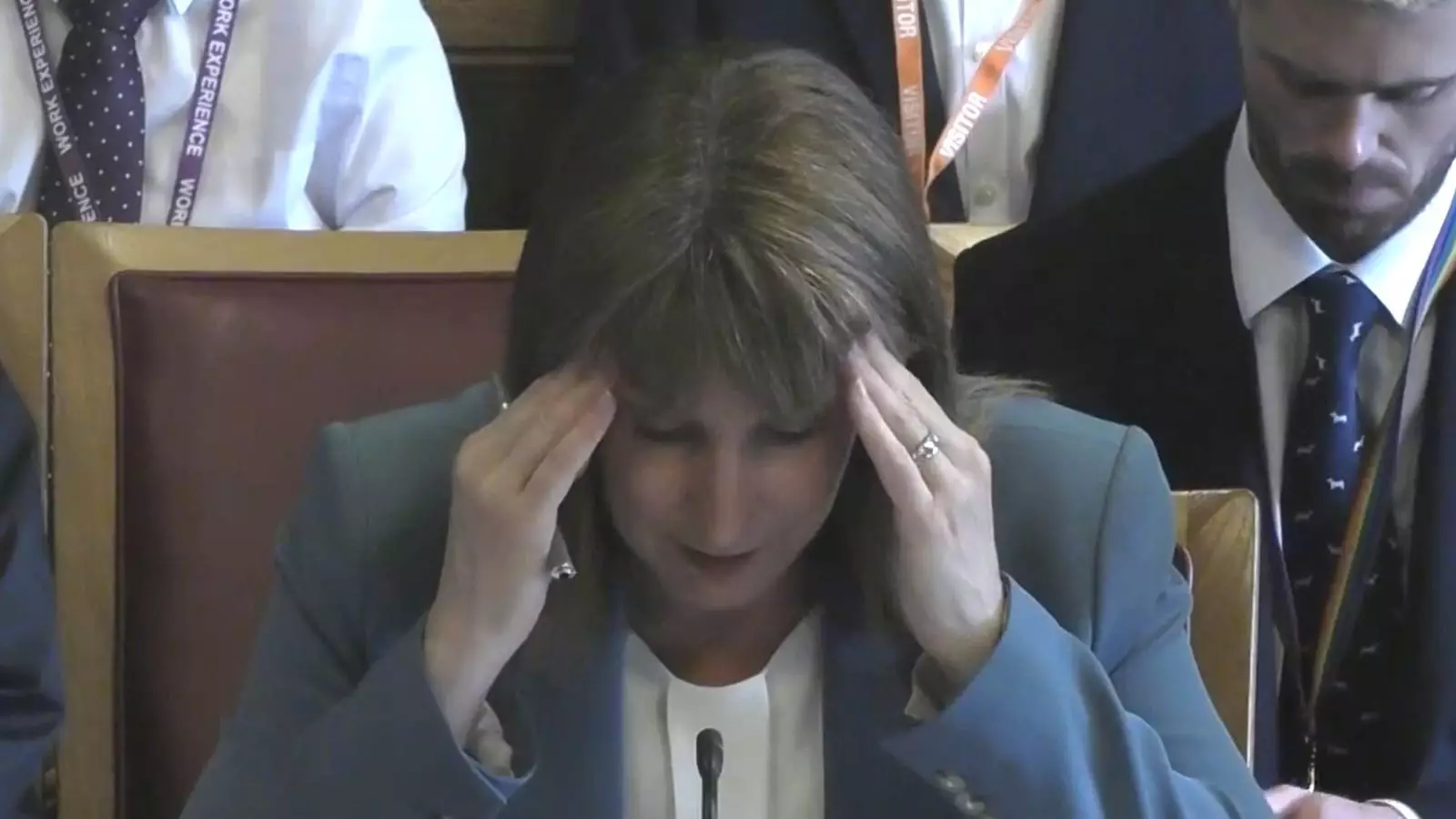

Policymaker Dilemmas: Navigating the Impossible Trilemma

The NIESR report emphasizes a so-called “impossible trilemma” that confronts policymakers: balancing fiscal discipline, spending commitments, and political promises. The government’s current trajectory—resisting tax hikes while maintaining generous welfare spending—creates an unsustainable nexus that could breed long-term financial fragility. The challenge is compounded by the political environment; social expectations and manifesto pledges often prevent the government from making tough but necessary fiscal decisions, trapping it within a cycle of unfeasible compromises.

This dilemma reveals a fundamental flaw in current governance—an unwillingness to confront the hard truths about tax and spending. The government’s restrictive stance on revenue enhancement is shortsighted, and, as NIESR advocates, a moderate but sustained increase in taxes is not only prudent but necessary. The erosion of trust in fiscal management is palpable, as bond markets and economic actors grow increasingly uneasy with the UK’s ability to manage future liabilities responsibly.

The Case for Progressive Reform: A Call for Fair and Smarter Taxation

The recommendations for reform also highlight the need for more equitable and innovative approaches to taxation. The report suggests reforming council tax, which has been its own source of political contention, or even replacing it with a land value tax. This kind of policy shift entails more than just redistributing revenue—it challenges deeply ingrained property tax structures that are outdated and less reflective of real economic value.

Progressive taxation isn’t just a matter of social justice; it’s about restoring fiscal resilience. Shifting the tax burden onto land and property—assets that often disproportionately benefit the wealthy—can help generate necessary revenue while addressing economic inequalities. Implementing such reforms requires political courage, a quality that has been noticeably absent in recent years. Instead, the UK appears trapped in a cycle of austerity and populism, with decisions often driven more by political expediency than strategic foresight.

Addressing Economic Inactivity: The Foundation for Sustainable Growth

Beyond revenue measures, the report spotlights a pressing need to address the rising economic inactivity that fuels welfare costs and hampers growth. The UK’s sluggish economy, combined with high welfare spending, creates a vicious cycle of stagnation. Cutting unnecessary welfare expenditures by incentivizing work and reducing barriers to employment could serve as a catalyst for healthier fiscal balances.

This approach, however, is easier said than done. It demands policies that foster inclusive economic participation—investments in education, skills, and public services that enable more people to contribute productively. Failing to act on this front risks entrenching economic disparities and further straining public finances, ultimately making the fiscal challenge even more daunting.

The Broader Context: A Fragile Economy in a Global Landscape

Economic growth forecasts remain modest, reflecting a cautious outlook for Britain’s future. With forecasts of just over 1% growth for the next couple of years, the UK risks slipping behind its G7 counterparts. Coupled with persistent inflation, these conditions threaten to wipe out household gains and exacerbate inequality—the very phenomena that center-wing liberalism seeks to combat.

Inflation at historically high levels, fueled by wage increases and government spending, continues to erode living standards, especially among the poorest households. The Bank of England’s tentative plans to cut interest rates may offer short-term relief but risk igniting further inflationary pressures. This delicate balancing act underscores the importance of sustainable economic policies that don’t just chase growth at all costs but prioritize long-term stability and fairness.

In essence, the UK’s current economic trajectory resembles a house of cards—built on shaky assumptions, unaddressed inequalities, and a reluctance to undertake necessary reforms. A future of austerity, if the status quo persists, threatens to deepen existing divides and undermine the social fabric. The critical question remains: will policymakers finally confront these challenges with the ambition and courage that the nation urgently demands?