The ongoing tensions surrounding foreign investment in U.S. industries underscore the intricate balance the Biden administration must maintain between national security interests and economic collaboration. The case of Nippon Steel’s proposed $14.9 billion acquisition of U.S. Steel epitomizes this challenge, sparking not only corporate legal battles but also international diplomatic tensions. The administration’s recent decision to postpone the order requiring Nippon Steel to withdraw its bid until June 2025 allows for a nuanced reevaluation of the situation, digging deeper into the broader implications for U.S.-Japan relations.

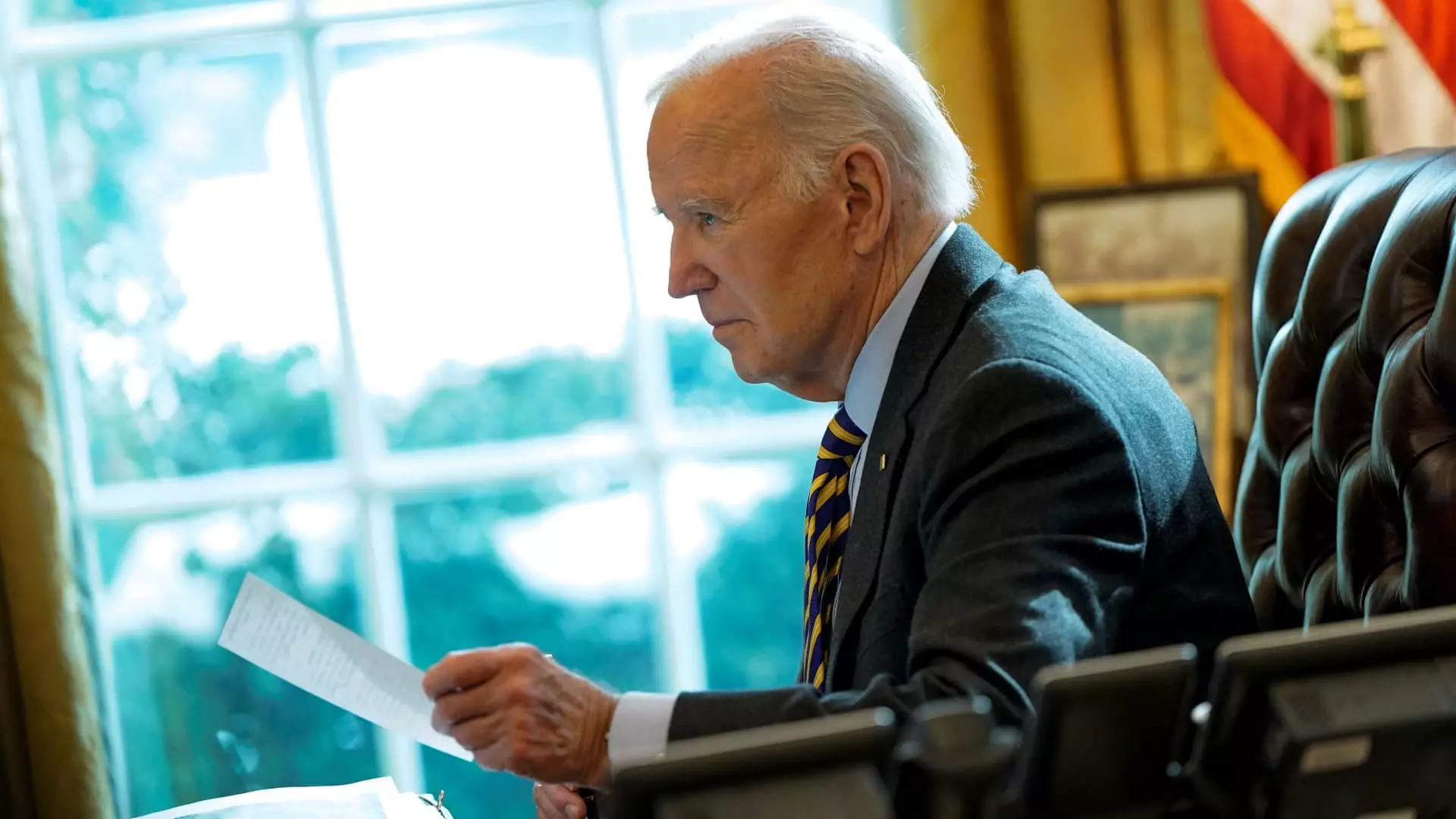

The initial rejection of the acquisition by President Biden on January 3rd, citing national security concerns, is reflective of a more significant trend in American politics where foreign investments, particularly from countries like Japan, are met with skepticism. The political landscape has changed significantly since former President Trump actively campaigned against foreign acquisitions, including Nippon Steel’s bid, as both candidates in the previous presidential election courted union votes. This dynamic raises questions about the influence of labor unions in shaping policy and the potential political motivations behind foreign investment reviews.

The Committee on Foreign Investment in the United States (CFIUS) plays a critical role in investigating foreign investment deals. This interagency review committee aims to prevent transactions that might pose risks to national security, which has historically been a significant concern, especially regarding alliances with G7 nations. The lack of consensus within the CFIUS regarding Nippon Steel’s acquisition bid ultimately necessitated a decision from President Biden, reaffirming the challenge of navigating competing interests. The steel companies’ allegations that the review process was inherently biased against them reflect a growing mistrust in the administrative procedures surrounding foreign investments.

As the legal dispute unfolds, U.S. Steel and Nippon Steel’s plans hinge on a successful appeal of Biden’s decision. Their argument centers around perceived prejudice in the CFIUS review process, leading to claims of unfair treatment. Such legal challenges not only affect the immediate outcome of this acquisition but also set precedents for future foreign investments in the U.S. Should the courts side with the steelmakers, it could reshape the landscape of how foreign transactions are evaluated, potentially increasing tensions between the U.S. government and countries such as Japan that are economically intertwined with American markets.

Japanese Foreign Minister Takeshi Iwaya’s recent comments highlight the fragile nature of U.S.-Japan relations, particularly in light of investment concerns. Japan stands as the largest investor in the United States, and inhibiting business transactions could have ramifications that extend beyond just the economic sphere—risking goodwill between two historically allied nations. Iwaya’s assertion that the decision to block the sale is regrettable reflects apprehension within the Japanese business community and suggests that broader diplomatic implications deserve consideration. This predicament places the Biden administration in a position where national security must be balanced against the ongoing benefits of robust economic partnerships.

The Nippon Steel-U.S. Steel case unearths significant questions about the future of foreign investment in America. As the deadline looms over the acquisition contract, the decision will have lasting repercussions on how foreign entities interact with American industries. The interplay between national security, corporate strategy, and international diplomacy will continue to challenge policymakers. Ultimately, the Biden administration must find ways to maintain vigilance against potential risks while fostering an environment conducive to continued partnership and investment—an intricate dance fraught with complexities that will no doubt shape the economic landscape for years to come.