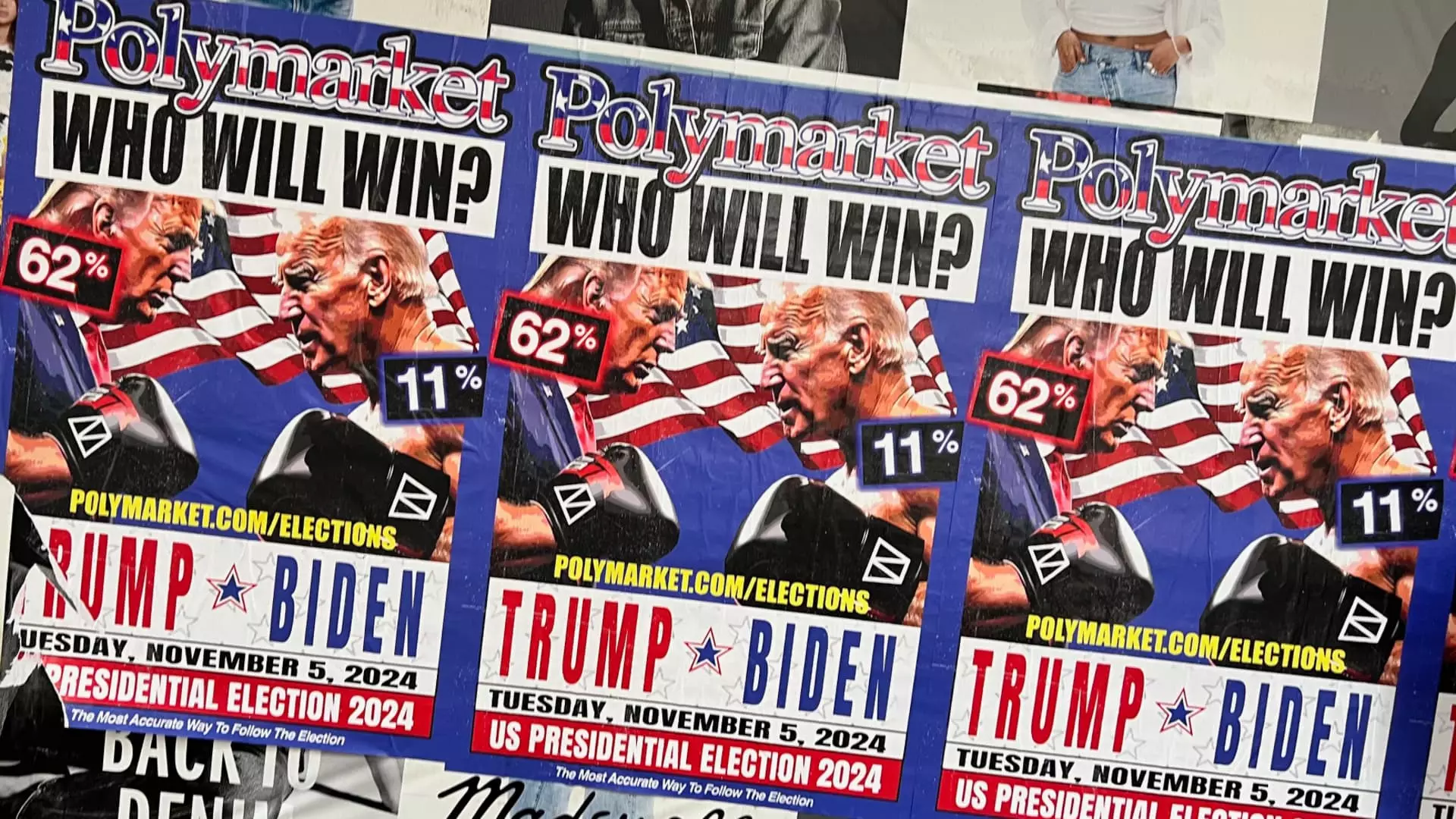

In recent times, the landscape of political prediction markets has undergone significant transformations. Polymarket, an online election betting platform, is set to re-enter the U.S. market after successfully predicting Donald Trump’s electoral victory. This move signifies not only a resurgence in its operations but also an opportunity to reshape how political outcomes are forecasted. As the regulations governing these markets evolve, Polymarket’s ambitions may foretell larger changes in the interplay between politics and finance.

Polymarket temporarily halted its operations in the United States in 2022, primarily due to legal issues that stemmed from its failure to register with the Commodity Futures Trading Commission (CFTC). The aftermath of this fallout was substantial, with the platform not only halting its services but also paying a hefty penalty of $1.4 million. However, the recent decision by the U.S. Appeals Court to lift restrictions on competitor Kalshi’s election contracts signals an environment more favorable to political betting firms. This judicial change inevitably impacts Polymarket’s prospects. With Zayn Coplan, the CEO, attributing the legalization efforts to those who “fought the battle,” it is evident that the groundwork for re-entry has been laid.

The recent judicial rulings and subsequent market entries by platforms like Interactive Brokers and Robinhood indicate that political prediction markets are gaining mainstream traction. Interactive Brokers’ founder, Thomas Peterffy, posited that such markets may evolve into a more significant entity than traditional equities. This perspective points to a burgeoning sector that could redefine public engagement with electoral processes. Meanwhile, Robinhood’s CEO, Vlad Tenev, emphasized that the financial stakes involved in these bets lead to more accurate forecasts, reinforcing the notion that economic investment fosters a more responsible analysis of political events.

One of the noteworthy aspects of Polymarket’s re-launch is its potential to harness economic incentives as a mechanism for enhancing accuracy in predicting electoral outcomes. Unlike conventional polling, which often relies on samples and statistical methods, prediction markets put real money on the line, thus attracting participants who have tangible stakes in accurate forecasting. This financial commitment arguably increases the reliability of the insights garnered from these platforms. The prediction market’s success in anticipating Trump’s win serves as a valid case study on how economically motivated forecasts align more closely with electoral realities compared to traditional polling methods.

While Polymarket enjoys a moment of positivity and potential, skepticism around the reliability of prediction markets persists. Critics often point out that high volatility in markets can lead to unpredictable outcomes, and the influence of social media personalities, such as Elon Musk, raises concerns about market manipulation. Musk’s enthusiastic endorsement of Polymarket, where he claimed it was “more accurate than polls,” beckons a conversation on the credibility of influencers in shaping market sentiment. As political climates remain charged, the integrity of these markets may be called into question, demanding robust regulations to safeguard their credibility.

As Polymarket re-establishes its foothold in the U.S. market, its journey may reflect broader trends in political engagement and predictive analytics. The shift in regulatory landscapes appears to favor innovation in betting markets, propelling them into the mainstream as credible tools for electoral forecasting. However, this transition must be approached with caution, ensuring that amid the enthusiasm for financial gains, the accuracy and reliability of predictions are maintained. Ultimately, if Polymarket and its peers navigate these complexities successfully, they may indeed redefine public discourse surrounding elections and the accountability of traditional polling methodologies. The coming years will be crucial in determining whether these platforms can sustain and capitalize on their predicted successes or if they will stumble as they compete within a turbulent and highly scrutinized market landscape.