In a significant turn of events within the technology sector, Nvidia has exited the exclusive $3 trillion club, leaving Apple as the sole occupant of this elite valuation. This shift occurred after Nvidia’s stock plunged by over 8% following its quarterly earnings report, which led to a staggering loss of approximately $273 billion in market capitalization. As of now, Nvidia’s market cap rests at $2.94 trillion. Simultaneously, the broader market, reflected in a 1.6% decline in the S&P 500 and a 2.8% drop in the Nasdaq, underscores an atmosphere of investor caution and volatility.

Nvidia’s current valuation is marking a noticeable decline of 10% year to date in 2025, as investors grapple with a constellation of concerns ranging from geopolitical factors like export controls and tariffs, to technological advancements paving the way for more efficient AI models. Despite this recent downturn, Nvidia’s worth has skyrocketed by a remarkable fivefold compared to its value two years ago, at the onset of the generative AI phenomenon. This meteoric rise peaked when the company first surpassed the $3 trillion market cap in June 2024.

A noteworthy aspect of Nvidia’s quarterly results is that they exceeded analysts’ predictions across various metrics. The company reported an astonishing 78% increase in revenue year-on-year, totaling $39.33 billion. Particularly striking was its data center revenue—which comprises its industry-leading graphics processors for AI applications—growing by an impressive 93% annually, approaching $36 billion. Nvidia’s ability to announce strong forecasts for the upcoming quarter lends credence to the company’s resilience, particularly after resolving production challenges associated with its next-generation Blackwell chip.

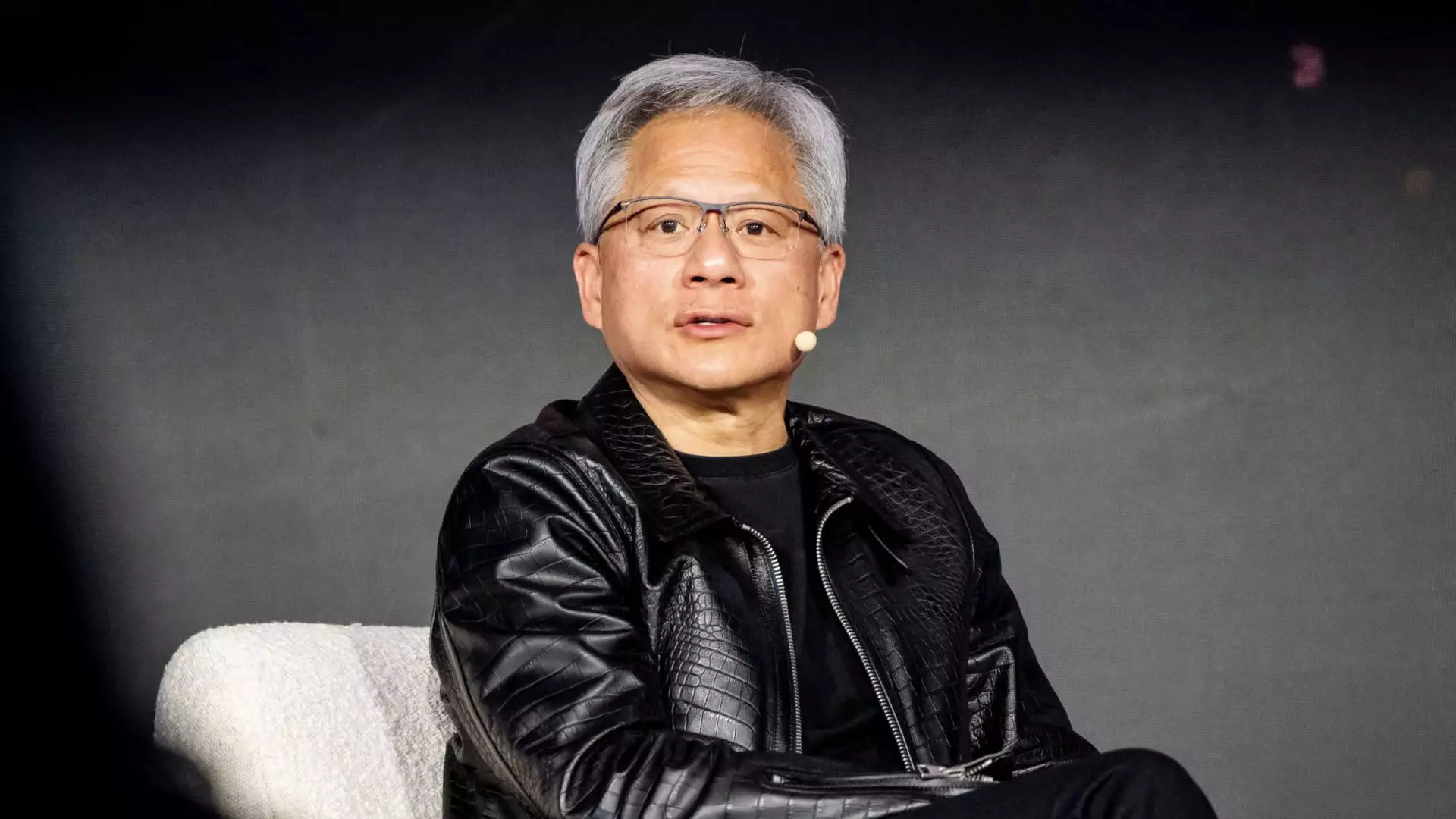

CEO Jensen Huang’s insights are pivotal in understanding Nvidia’s strategic outlook, as he emphasized that the anticipated demand for their chips is set to surge. He articulated that the evolving landscape of AI requires an unprecedented amount of computational power to facilitate nuanced reasoning processes in newer models. Huang’s remarks underscore a critical point: as the complexity of AI tasks increases, so does the demand for Nvidia’s innovative technology, which currently serves as a backbone for major cloud service providers like Microsoft, Google, and Amazon. These giants alone contribute to about half of Nvidia’s data center revenue, showcasing the symbiotic relationship between Nvidia and the largest players in the technology sector.

As Nvidia navigates through uncertain waters, its dual challenge lies in addressing investor fears while capitalizing on burgeoning market opportunities. The company is at a pivotal crossroads where it must bolster its growth trajectory amidst concerns of market saturation for AI technologies and geopolitical strains affecting global supply chains. Building on its remarkable growth and robust revenue streams from data centers, Nvidia could harness its position to not only recover but thrive in an evolving tech panorama.

While Nvidia’s exit from the $3 trillion club serves as a sobering reminder of market volatility, it also highlights the dynamic nature of the technology sector. With Apple standing alone at the summit of this valuation milestone, the path forward for Nvidia will demand strategic foresight, innovation, and adaptability to maintain its esteemed position as a leading player in the AI and tech landscape.