Despite the swirling chaos in global markets, some stocks shine bright like diamonds, defying the prevailing pessimism. Major players such as Netflix, Amazon, Nvidia, and Boot Barn are not just thriving; they are positioned for explosive growth as we move further into the summer. Bank of America, an investment giant, has highlighted these companies as buy-rated stocks, and for good reason. Their strategic advantages, innovative prospects, and resilient business models make them the best bets in a battered economic landscape.

Netflix: The Streaming Powerhouse

Netflix is arguably the poster child of resilience in the entertainment industry. Analyst Jessica Reif Ehrlich has taken a bold stance, significantly raising her price target on Netflix’s shares to an impressive $1,490. Such optimism is not unfounded. The streaming platform has successfully combined user-friendly interfaces, a treasure trove of content, and aggressive marketing strategies that have accelerated subscriber growth. Unlike its competitors, Netflix has shown the ability to adapt quickly to changing market dynamics, especially in the face of regulatory challenges like tariffs, which have crippled other firms.

Furthermore, with the ramp-up of its advertising technology, Netflix is not simply resting on its laurels; it is innovating and evolving. The company’s unmatched scale in the streaming realm is a fortress against competition, and with its foray into sporting and live content, the potential for expanding its user base becomes even grander. Continuing to witness a 39% increase in value this year reaffirms that Netflix is not just surviving; it is thriving and evolving in unprecedented ways.

Amazon: Robotic Revolution on the Rise

Just as impressive is Amazon, a retail titan whose stock performance has recently gained a fresh boost due to advancements in robotics. Analyst Justin Post has uplifted Amazon’s price target to $248 per share, showcasing the firm’s continuing optimism. The potential of automation, particularly through robotics and drones, cannot be overstated.

Amazon envisions a future where labor dependency is drastically reduced, order accuracy is significantly improved, and warehouse efficiency is supercharged, leading to cost savings that could benefit consumers and shareholders alike. In this manner, Amazon is set to not only retain but enhance its competitive moats. The ripple effects of its ambitious plans could redefine the e-commerce landscape, bringing forth a seamless shopping experience that entices even the most reticent customers. With a growth streak of over 15% in the past year, it’s evident that Amazon is prepared to capitalize on major trends such as cloud computing and online advertising.

Boot Barn: A Unique Niche’s Resurgence

Boot Barn, the lesser-known but equally fascinating company, deserves a mention in this lineup. Its recent stock performance has caught the eye thanks to a variety of positive catalysts, as pointed out by analyst Christopher Nardone. With a price target increase to $192 per share, Boot Barn’s expansion across various merchandise categories and regions hints at a robust growth trajectory that extends well into the future.

The Western-themed retail segment might seem niche, but Boot Barn has managed to carve out a solid place in the market by offering a unique blend of quality products and customer service that can’t be easily replicated. Its strategy of leveraging scale for better pricing structures keeps competitors at bay, while a friendly pricing environment raises the prospect of tangible gains. With an 8% rise year-to-date, the company embodies the pivot towards specialized retail niches that are increasingly becoming popular in a world thirsty for authenticity.

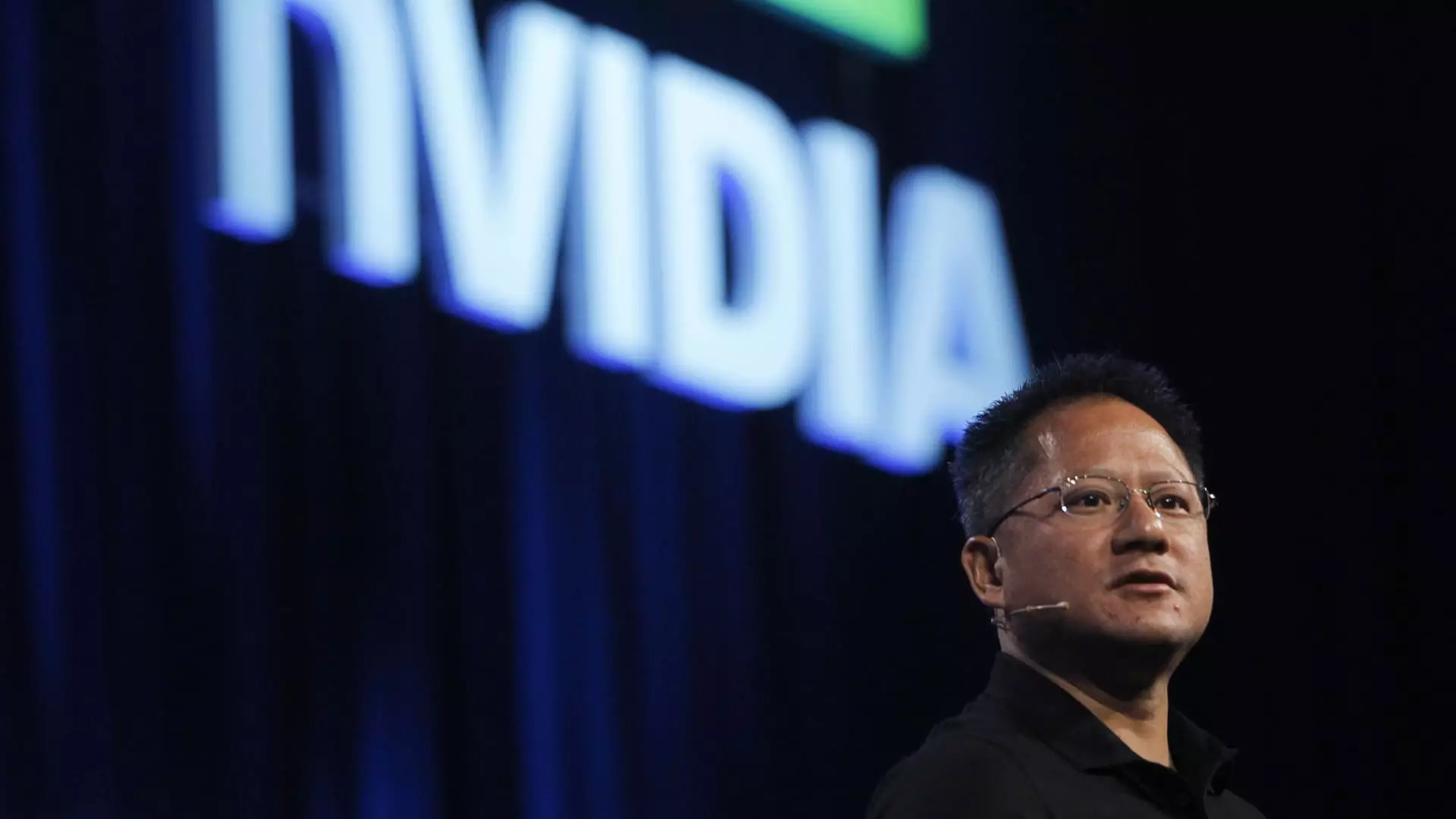

Nvidia: The AI Leader

At the forefront of technology is Nvidia, an undeniable leader in artificial intelligence and graphics processing units. The company’s strength in AI demand is unwavering, and analysts suggest that it maintains a leading position among its competitors—a critical factor in our AI-driven future. Nvidia’s ambitious price target of $180 per share reflects not only the current optimism surrounding the stock but also highlights its multi-year potential supported by an exceptional pipeline and developer support.

In a world where the demand for AI applications continues to surge, Nvidia stands out as a trusted provider with deep insights and resources. Its dominance in performance surpasses that of competitors, securing its place at the cutting edge of technological advancements. As industries quickly integrate AI into their frameworks, Nvidia is poised for monumental progress amidst a prevailing tide of innovation.

A Fragmented Market, Yet These Stocks Unite

The narratives of these stocks display a universal truth: in the midst of a fragmented and often turbulent market, there are diamonds waiting to be discovered. Each of these companies brings something unique to the table, and together, they encapsulate the spirit of innovation and resilience that often define the success stories in the stock market. There’s no denying that growth is projected for these stocks in the upcoming period, and those who remain invested may be in for a rewarding journey.